We Accept Bitcoin

Get 10% Off Any Service Package When Paying in Bitcoin

At ETD we believe Bitcoin is the future of global value transfer: permissionless, trustless, cross-border, final settlement... all within a few hours. That is why we offer a 10% discount on any service package when you choose to pay in Bitcoin.

What is ETD's Bitcoin Payment Process?

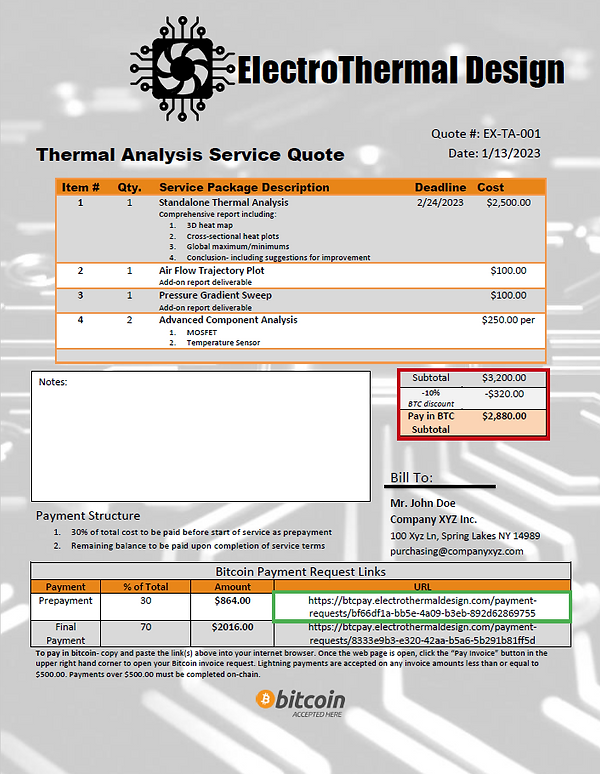

To begin the process, please let us know how we can be of service by reaching out to us via the page or the chat box in the lower right corner of the screen. After settling on an appropriate service package, make sure to mention that you would like to see the "pay in bitcoin discount" added to the quote. ETD will then provide a quote, similar to the example quote pictured below. The quote will display two subtotals, the first is market price and the second is the discounted price for Bitcoin payments. In the example quote below, the subtotals can be found outlined in red.

Example Quote

If the customer would like to make the purchase in BTC, they will follow these three easy steps.

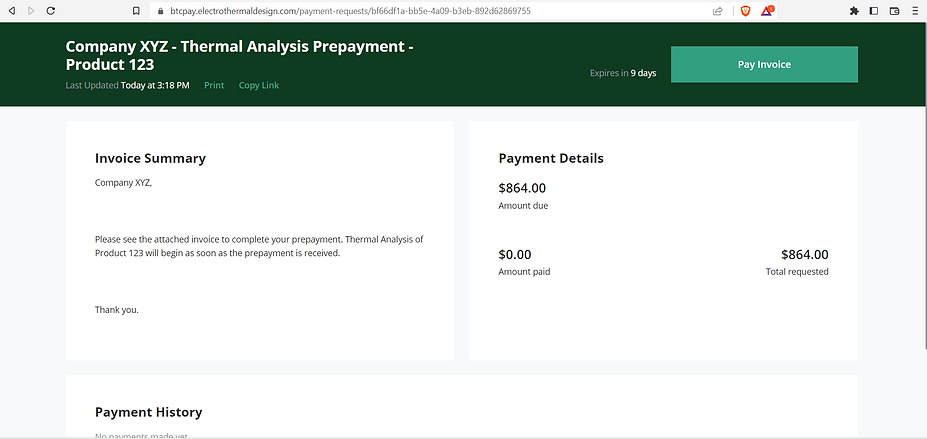

Step 1: Locate the link to the appropriate payment request within your quote. Copy and paste the link into your internet browser. It will take you to a personalized BTCPay request form.

In the example above, Company XYZ has just received their quote from ETD and are ready to initialize the service agreement. They would then copy the link to the prepayment request (outlined above in green), paste it into their web browser, and hit enter. This will open Company XYZ's custom payment request, which lives on ETD's pay server.

Payment Request

Step 2: Double check the payment details displayed on the payment request. If satisfied click the "Pay Invoice" button in the upper right corner of the page. This button will take you to the invoice.

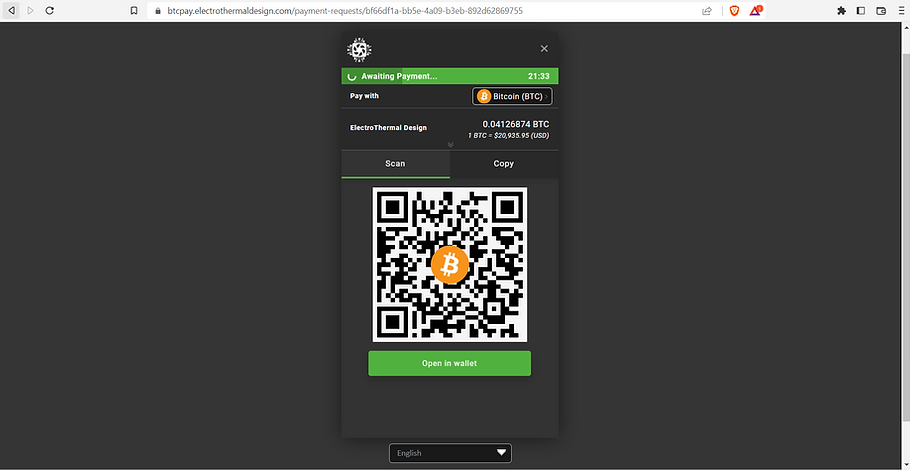

Invoice

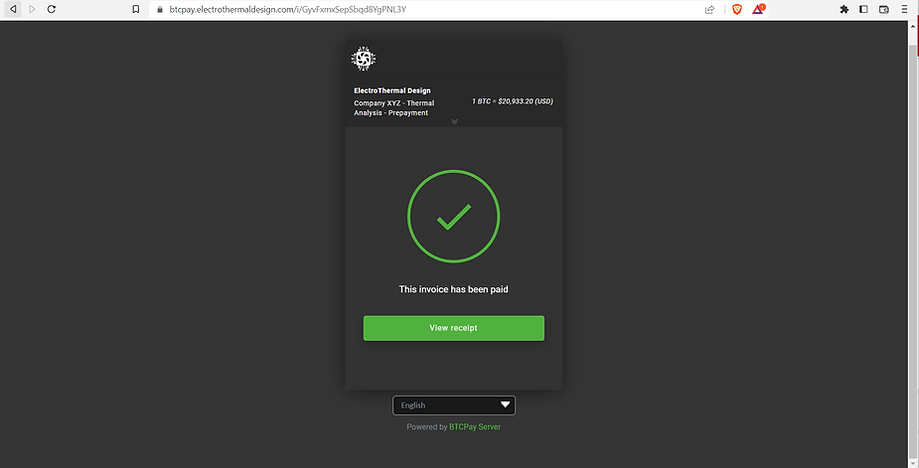

Step 3. Complete the invoice using your bitcoin wallet of choice by either scanning the QR code or copying and pasting the address text. After the payment has settled you will receive a confirmation* with the option to view your receipt, seen below.

*Please note that when paying on-chain the confirmation can take up to an hour.

Confirmation

Receipt

Why Bitcoin?

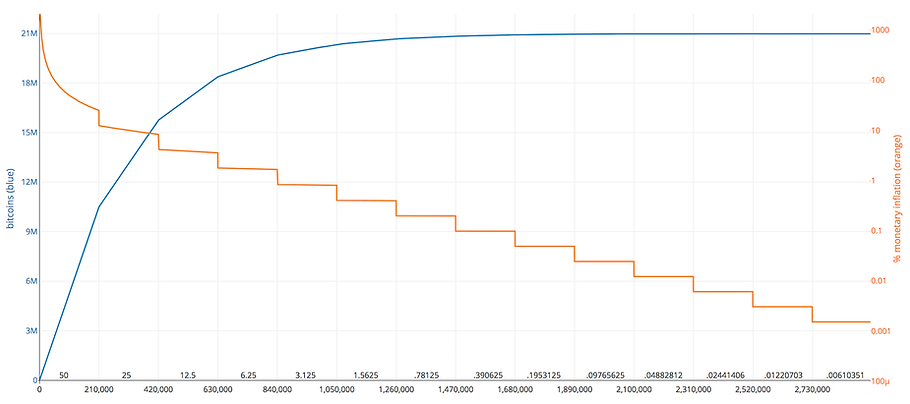

The Discovery of Digital Scarcity

In 2009 Satoshi Nakamoto released Bitcoin, an open source, peer to peer payment protocol. It combines a chain of digital signatures, a time stamp server, and proof-of-work consensus to create an immutable online ledger, that anyone can access but no one can control. This genius design simultaneously solves both the Byzantine Generals Problem and the Double Spend Problem, two road blocks that prevented the rise of decentralized electronic cash for decades. Satoshi equipped the protocol with a monetary issuance schedule, where there will only ever be 21 million bitcoin in existence. Hence, with the successful launch of Bitcoin in 2009 the world was exposed to the first ever instance of absolute, digital scarcity.

Thermodynamically Sound Money

Every system throughout the natural world must adhere to the laws of thermodynamics. Money is no exception. The underlying, base function of money is to act as a system of value exchange, or put another way- a system of energy exchange. Units of money are representations or placeholders that can be exchanged for energy intensive goods and services. Although the money itself does not have any physical utility, those who use a reliable money can rest assured that they will be able to exchange it for real-world value in the future.

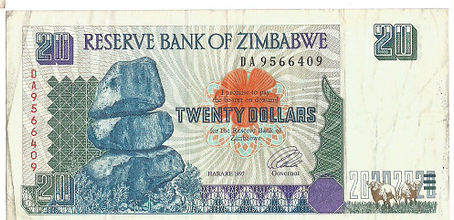

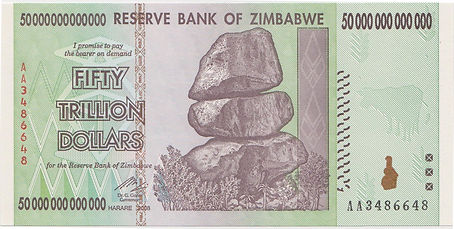

Before 2009, every form of money known to man had a subtle, yet fatal flaw. They all leaked energy, through a process called inflation. Monetary inflation is simply when additional units of money are inserted into a monetary system. Some instances of inflation, such as the banknotes of Zimbabwe, reveal just how fast a leak can turn into the whole dam breaking. The people of Zimbabwe saw their paper wealth lose over 99.999% of its value in less than a decade. While other systems, such as gold, have been held in check- with an average inflation rate of ~2% over the past century. But what exactly causes some forms of money to leak value faster than others?

20 Dollar Zimbabwe Note- Issued in 1997

50 Trillion Dollar Zimbabwe Note- Issued in 2009

When taking a look at the history of money, it is fair to say gold has been the most reliable for mankind over the millennia, especially in terms of a store of value. But why gold? What about this one metal has caused it to preserve purchasing power better than other metals and especially better than paper money? The answer is somewhat unintuitive. Unlike paper money, gold has no issuer. Instead, the global supply of gold can only be expanded when new deposits are mined out of the Earth's crust. It just so happens that gold is a very unique element. It can not be reproduced in a laboratory setting, it is sufficiently scarce, evenly distributed throughout the Earth, and requires a huge amount of energy to extract meaningful quantities. These characteristics all contribute to the secret of golds success- the inability to centrally control its supply and issuance.

Another, more technically correct way, we could describe this phenomenon of leaky money is through thermodynamics. A money is more thermodynamically sound when the cost (in joules) of inflating the supply is great enough to outweigh the benefit, and therefore deter inflation. In the world of physical goods, gold comes closest to achieving this balance. As stated above, a monetary system leaks energy when new monetary units are added to the system. It is the gold mining market, which is extremely competitive and thermodynamically intensive, that allows gold to retain a low inflation rate. This is why gold has been highly sought after, as the premier form of value-saving money... until Bitcoin.

Satoshi Nakamoto designed the monetary policy of the Bitcoin protocol to have an exponentially decaying inflation rate. The protocol is set to mine the last fractions of bitcoin in the year 2140, at which point inflation is no longer possible. Like gold, the only way to mine bitcoins is through an extremely energy intensive process. However, this type of mining does not require diesel and heavy machinery, but electricity and specialized computers. The energy intensive mining and capped 21 million supply insure that Bitcoin will continue to hold more and more of its monetary energy over the next 100+ years. Until, in 2140 the thermodynamic cost of inflating the supply of Bitcoin will arrive at its final destination- infinity.

Bitcoin is the worlds first and only thermodynamically sound money.

Bitcoin Issuance and Inflation Rate